Is Real Estate Investment Trusts a Good Career Path? — Opportunities in 2023

Oct 26, 2023

For those looking to break into the real estate industry, Real Estate Investment Trusts (REITs) can provide exciting and rewarding career opportunities. According to the Nareit study, REITs support more than three million full-time jobs in the US, including brokers, investor relations, accountants, architects, designers, financial analysts, property managers, marketers, developers, human resources, and many others.

But can a career in REITs be a wise choice? In this article, we will explore what REITs are, how they work, and the best-paying jobs in real estate investment trusts.

Key Takeaways:

- REITs are structured similarly to funds, allowing investors to access the real estate sector without having to manage the physical assets.

- There are several types of REITs, including equity, mortgage, and hybrid. Equity REITs purchase and manage properties, while mortgage REITs provide financing for real estate projects.

- The decision of whether REIT investing is the right choice for you is based on your goals, interests, and tolerance for risk.

- A career in REITs can be a great way to be involved in the real estate industry while also having the potential to earn a lucrative income.

What is a Real Estate Investment Trust?

A Real Estate Investment Trust is a type of company that owns and operates income-producing real estate assets. Most REITs are publicly traded on the stock market, and they use investors’ capital to purchase and manage real estate properties.

REIT is structured similarly to a mutual fund or exchange-traded fund (ETF), allowing investors to purchase shares of the trust rather than individual properties. Investing in REITs is similar to investing in funds, except that the capital is invested in real estate rather than a set of publicly traded companies. The returns are more stable, as rental income from properties is less affected by economic fluctuations than stock prices.

REIT companies can own a variety of assets, such as offices, apartments, retail stores, hotels, storage facilities, and warehouses. Basically, they own a portfolio of properties, providing investors with the potential to diversify their investments.

The best thing about REITs is the opportunity for investors to earn dividends without the need to manage properties themselves. Additionally, the unique structure of REITs allows investors to take advantage of tax benefits, such as reduced taxation on income derived from real estate investments.

How Do REITs Work?

REITs generally have a simple business model. They purchase and manage real estate properties using investors’ capital. The REIT then leases the property space, collecting rent payments from tenants. The rent payments are then distributed as dividends to shareholders.

The other type of REIT, mortgage REITs, however, do not own any actual property – they invest in real estate, providing loans to buyers of real estate properties. The interest they earn on their investments is the source of income for these REITs.

Types of REITs

There are three main types of REITs. Each type has its own unique characteristics and investment focus:

Equity REITs

Equity REITs are the most common type of investment trust. These companies invest in and own income-producing properties such as office buildings, shopping centers, and apartment complexes.

Equity REITs generate income primarily through rental income from these properties. They may also benefit from property appreciation over time. Investors in equity REITs receive dividends based on the rental income generated by the properties in the REIT’s portfolio. This type of REIT is ideal for investors looking for a steady income and long-term capital appreciation.

Mortgage REITs

Mortgage REITs, on the other hand, invest in mortgages and mortgage-backed securities rather than physical properties. These entities earn income by lending money to real estate owners or by purchasing existing mortgages.

Mortgage REITs make money through the interest payments received on borrowers’ loans. They provide investors with high dividend yields and are attractive to investors seeking higher yields and shorter investment horizons. However, these REITs are potentially sensitive to an increase in interest rates.

Hybrid REITs

Hybrid REITs combine elements of both equity and mortgage REITs. They invest in a mix of physical properties and mortgage-backed securities.

Hybrid REITs aim to diversify their income sources, generating both rental income from properties and interest income from mortgages. These entities offer a balanced approach for investors who want exposure to both real estate assets and mortgage-related investments.

Fast Fact

There were more than 1,100 REITs in the US, according to the Internal Revenue Service’s data. 225 of them are traded on major stock exchanges.

REITs can also be classified based on how their shares are bought and held:

- Publicly Traded REITs: Those that are listed on stock exchanges and can be bought and sold by the general public. These REITs are subject to the same regulations and reporting requirements as any other publicly traded company. Investors can easily buy and sell shares of publicly traded REITs through brokerage accounts, making them highly liquid investments. These REITs often have a larger market capitalization and a more diversified portfolio of properties.

- Public Non-Traded REITs: Those that are also registered with the Securities and Exchange Commission (SEC) but do not trade on stock exchanges. Instead, they are typically sold through broker-dealers or financial advisors. Investors in public non-traded REITs may have limited liquidity options, as these investments are generally illiquid for a certain period of time. However, they may offer potential advantages such as higher dividend yields and lower volatility compared to publicly traded REITs.

- Private REITs: These REITs are not registered with the SEC and are not available to the general public. They are typically only open to accredited investors or institutional investors. Private REITs often have a more focused investment strategy and may target specific types of properties or geographical regions. While private REITs offer the potential for higher returns due to their targeted approach, they also come with higher risks and limited liquidity options.

How a Company Can Be Qualified as a REIT?

To qualify as a REIT, a company must adhere to specific provisions, which serve to ensure that REITs operate in a manner consistent with their purpose and provide certain benefits to investors:

One of the key requirements is that at least 75% of the company’s total assets must be invested in real estate. This ensures that the primary focus of a REIT is on real estate investments rather than other types of assets.

In addition to the asset requirement, a REIT must derive at least 75% of its gross income from rents, interest on mortgages, or real estate sales. This provision further ensures that the majority of the company’s revenue is generated through real estate-related activities. By relying primarily on these sources of income, REITs align their financial interests with those of their shareholders.

Rent income and interest on mortgages are typically stable and predictable sources of revenue, providing a level of consistency and reliability to the overall returns generated by a REIT.

Furthermore, a key characteristic of REITs is their obligation to distribute at least 90% of their taxable income to investors as dividends. This requirement ensures that investors benefit from the cash flows generated by the real estate holdings within the REIT structure.

By distributing a significant portion of their earnings, REITs provide regular income to shareholders, which can be especially attractive for income-oriented investors seeking steady cash flow. This distribution requirement also reflects the tax advantages associated with REITs, as it allows the company to avoid double taxation at the corporate level.

Other requirements include:

- Being a corporation-taxed entity

- Being governed by a board of directors or trustees

- Having 100 shareholders after one year of operation

- Having fewer than five shareholders owning more than 50% of the shares

Advantages of a Career in REITs

Working in the REIT industry can offer several advantages:

- Diversification: REITs provide investors with the opportunity to diversify their real estate investments across different property types and locations. This diversification can help mitigate risks associated with investing in a single property.

- Steady Income Stream: Working in the REIT industry can provide a steady income stream through regular dividend payments.

- Professional Growth Opportunities: The REIT industry offers various career paths and opportunities for professional growth. From property management to asset management and development, individuals can build successful careers in different areas of the industry.

- Liquidity: Publicly traded REITs offer liquidity, allowing investors to buy and sell shares on major securities exchanges. This liquidity provides flexibility and the ability to adjust investment portfolios as needed.

Fast Fact

As of September 2023, the one-year average dividend yield for publicly traded US equity REITs was almost 4%.

Disadvantages of a Career in REITs

Despite the benefits of working in the REIT industry, there are some potential disadvantages:

- Limited Capital Appreciation: REITs are obligated to distribute significant amounts of income to shareholders as dividends. This limits the amount of income that can be reinvested in the company for capital appreciation. As a result, REITs may not offer the same level of capital appreciation as other investment options.

- Taxation: Dividends received from REITs are typically taxed as regular income. This can result in a higher tax burden compared to other types of investments, such as long-term capital gains.

- Management and Transaction Fees: Some REITs may charge management and transaction fees, which can impact overall investment returns. It is important to carefully consider these fees when evaluating the potential profitability of investing in a particular REIT.

Is a Career in REITs a Wise Choice?

Working in the REIT sphere can be a rewarding and fulfilling career choice, especially if you are already interested in investing in real estate. By joining a REIT company, you will gain valuable insights and knowledge about this unique investment field and learn how to operate effectively within it. As a part of a REIT company, you will have access to valuable resources and industry expertise, enabling you to make informed investment decisions.

Additionally, if you have strong management skills, the REIT sphere offers an ideal environment for you to showcase and further develop your abilities. REITs require skilled professionals who can effectively manage properties, handle tenant relationships, and optimize operational efficiencies.

Lastly, being comfortable with a certain level of risk is crucial in the REIT market. While individual investments may carry risks, as a professional in this industry, you must be able to assess and manage risk on behalf of your clients. Your ability to navigate uncertainties and make informed decisions can greatly impact the success of your clients’ investments.

Ultimately, deciding whether a career in REITs is a good idea for you depends on your career goals, interests, and risk tolerance.

Best-Paying Jobs in Real Estate Investment Trusts

The REIT industry provides various job opportunities with competitive salaries. Here are some of the best-paying jobs in real estate investment trusts:

- Chief Investment Officer (CIO): The CIO is responsible for overseeing the investment strategies and decisions of a REIT. They must ensure that the company is investing in the right properties and that their investments are profitable.

- Portfolio Manager: Portfolio managers are responsible for managing the assets of a REIT’s portfolio. Specifically, he or she analyzes market conditions, monitors property performance, and makes strategic decisions to maximize returns.

- Property Manager: Property managers are responsible for managing the day-to-day operations of a REIT’s real estate assets. They are responsible for maintaining the property, negotiating leases, and dealing with tenants.

- Real Estate Analyst: A real estate analyst conducts market research, financial analysis, and due diligence on potential real estate investments. This professional provides insights and recommendations to support investment decision-making. It is essential for real estate analysts to possess strong analytical skills and to have deep market knowledge.

- Development Manager: Development managers oversee the planning, design, and construction of new real estate projects. They coordinate with architects, contractors, and other stakeholders to ensure projects are completed successfully. Development managers require strong project management skills and a thorough understanding of the development process.

These are just a few examples of the high-paying jobs available in the REIT industry. The salaries for these positions can vary depending on factors such as experience, location, and the size of the REIT.

FAQs

Are there REITs in countries other than the US?

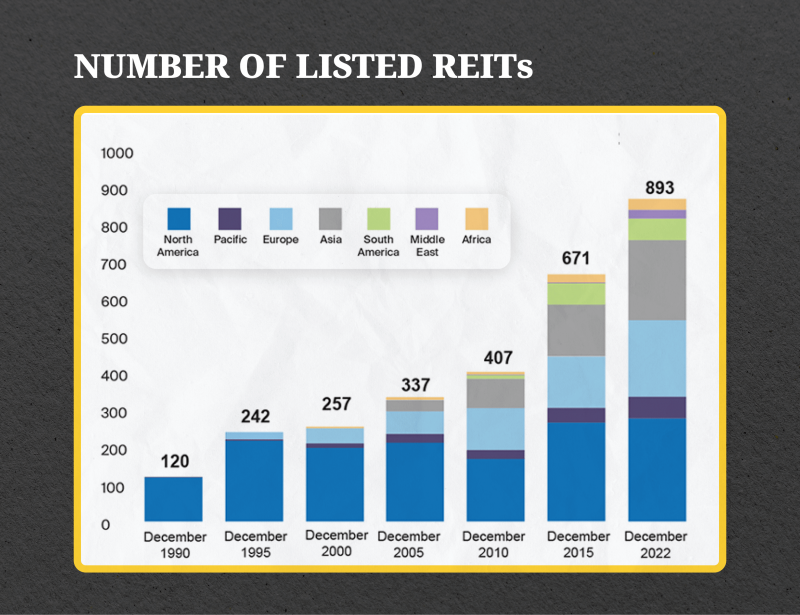

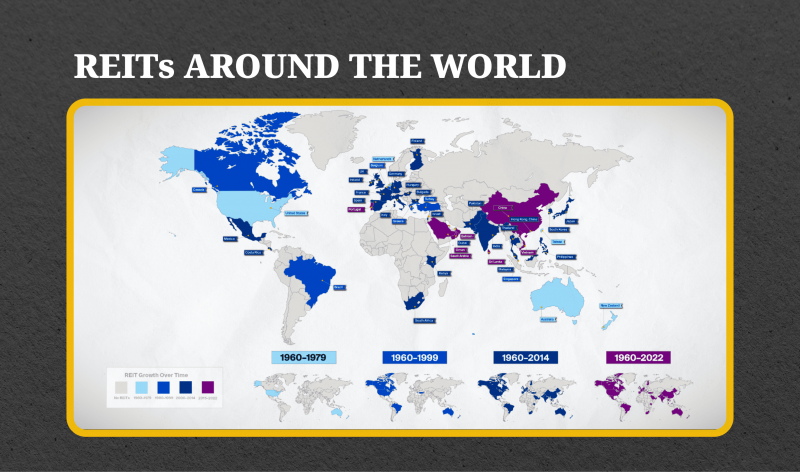

Yes, more and more countries are introducing REITs. In fact, there are currently REITs in over 35 countries, including Canada, Japan, Australia, France, Germany, Singapore, the United Kingdom, and more.

How do REITs benefit investors?

REITs offer investors a way to diversify their portfolios with real estate investments that have the potential for high returns. Investing in REITs can provide investors with higher yields compared to investing in stocks or bonds. Additionally, REITs are relatively low-risk investments since their income is backed by physical properties. This can provide investors with a steady stream of income and a hedge against market fluctuations.

Is investing in REITs risky?

Investing in REITs can be risky, as with any investment. However, REITs provide investors with diversification benefits and access to professionally managed real estate portfolios, which can help minimize risk. Additionally, REITs have the potential to provide attractive income and total return. As with any investment, it is important to do your research and assess the risk before investing.

When and why were REITs created?

REITs were created in 1960 in the United States as an investment vehicle to allow individuals to invest in large-scale real estate projects. The purpose of REITs was to make real estate investments more accessible to the public.